Working Together For Nearly 70 Years

The Civil Service Employees Association (CSEA) is committed to providing job protection and membership services for over 265,000 public employees throughout New York State. Pearl Insurance LLC has been exclusively endorsed to assist in this commitment by providing access to a wide variety of insurance products that can help to protect the personal financial security of CSEA members. For nearly seventy years, Pearl Insurance LLC has worked with CSEA to provide members with access to affordable, high quality insurance options. The following is a brief outline of the comprehensive coverage available to you as a CSEA member.

CSEA Security Life Insurance - Premier Plan

This term life insurance is available to all active CSEA members under age 70, their spouses under age 66, and their dependent children 15 days to 18 years of age. CSEA membership is required to apply and continue this insurance. Designed to meet your needs, the following benefits are available for CSEA members only.

- $50,000 Guaranteed Issue within the first 180 days of CSEA membership

- $250,000 plan maximum for members only (If your dependent spouse or child is covered for Life Basics or Premier Plan as a member under this plan, the combined amount of your life benefits and your spouse's or child's life benefits may not exceed $250,000).

- Dependent coverage extends members' coverage to include spouse and children (spouse coverage available from $10,000 to $150,000) Child(ren) coverage of $5,000 or $10,000 is available

- Group rates

- Line of Duty Benefit

- Accelerated Death Benefit

- Accidental Death and Dismemberment Benefit

- Seat Belt Benefit

- Travel Accident Benefit

- Premium Waiver

- No age limit if coverage is in place for ten years and purchased before age 60

- Convenient Payroll Deduction or EZ Paysm Plan

- Simplified Application

- Underwritten by Metropolitan Life Insurance Company, New York, NY*

*Like most group life insurance policies, MetLife group policies contain exclusions, limitations terms and conditions for keeping them in force. For costs and complete details of the coverage call Pearl Insurance at (800) 929-6656

CSEA Security Life Insurance - Life Basics Plan

Because the price reflects the statistical risk that you may die while the policy is in force, premiums increase as you grow older. With term insurances, you only pay for the protection that you need. The rates under this program reflect the elimination of the additional benefits offered under the Premier Term Life plan. This plan is available to all active CSEA members under the age of 60. Designed to meet your needs, the following benefits are available for CSEA members only:

- $50,000 Guaranteed Issue within the first 180 days of CSEA membership

- Affordable group rates based on the members' attained age

- Coverage amounts range from $10,000 to $250,000 for member

- Dependent coverage extends members' benefits to include spouse and children (spouse coverage available from $10,000 to $150,000) child(ren) coverage of $5,000 to $10,000 is available. If your dependent spouse or child is covered for Life Basics or Premier Plan as a member under this plan, the combined amount of your life benefits may not exceed $250,000).

- Underwritten by Metropolitan Life Insurance Company, New York, NY*

*Like most group life insurance policies, MetLife group policies contain exclusions, limitations terms and conditions for keeping them in force. For costs and complete details of the coverage call Pearl Insurance at (800) 929-6656

CSEA Disability Income Protection Plans

Available to all CSEA members under age 60 who are regularly and actively performing the duties of their occupation according to their regular schedule on a full time basis. CSEA membership is a necessary condition of insurance. Two plans to choose from:

CSEA Classic Disability Income Plan

- Provides monthly benefits for up to 12 months for Total Disability due to covered Sickness or Accident

- Lifetime Benefit Period Option for covered Off-the-Job Accidents

- 2 year Benefit Period Option for covered Sickness and On-the-Job Accidents

CSEA Basic Disability Income Plan

- Provides monthly benefits for up to 6 months for Total Disability due to covered Sickness or Accident

- Highlights under BOTH PLANS include:

- Up to $2,000 in monthly benefits available (based on salary schedule)

- Benefits for pregnancy

- Benefit for medical expenses

- Hospital confinement not required

- Convenient payroll deduction

- $5,000 Accidental Death and Dismemberment Benefit

- Work Stoppage Benefit

- Reduced premiums for 30 day waiting period option

- Easy application process

- Survivor Benefit

- Vocational Rehabilitation Provision

- Underwritten by New York Life Insurance Company, New York, NY 10010 - Policy Form GMR

Family Protection Policy

Available to all CSEA members and spouses aged 18 through 64, and their children, ages 15 days through 24 years. This group whole life insurance may be used to supplement any life insurance you may currently have.

Highlights include:

- $10,000 Guaranteed Issue for new member applying within the first 60 days of CSEA Membership

- Permanent life insurance that builds cash value

- Level premiums which can never be increased

- Five payment plan options

- Continuation of coverage beyond employment

- Waiver of premium feature

- Non-smoker discounts

- Living benefit/accelerated death benefit

- Underwritten by New York Life Insurance Company, New York, NY 10010 - Policy Form GMR

Protection Plus Universal Life Insurance

Available to all CSEA members under age 70 and spouse under age 65 and their children 15 days through 25 years. This Universal Life Insurance can be used to supplement other life insurance you currently have. Highlights include:

- Convenient payroll deduction

- Waiver of cost of insurance for disability

- Unisex rates

- Adjustable benefits & premiums

- Flexibility of coverage up to plan maximum

- Valuable loan option

- Underwritten by The United States Life Insurance Company in the City of New York, NY - Policy Form #9245IN

Critical Illness

This coverage pays a lump sum payment to offset the unexpected costs associated with surviving a critical illness. Provides insured with valuable protection and the freedom to choose the lifestyles and treatments they prefer.

- Coverage available from $5,000 to $500,000

- Covered illness include: Cancer, Heart Attack, Kidney (Renal) Failure, Stroke, and a condition requiring major organ transplant as defined in the certificate of insurance

- Preventive Care Benefit also known as a Wellness Benefit. A $50 benefit paid toward pre-screening tests

- Full payment paid directly to you in addition to any other benefit you may receive from another company

- Convenient Payroll Deduction

- Underwritten by National Union Fire Insurance Company of Pittsburgh, PA

Child Permanent Life Insurance

$15,00 - $6,00 per paycheck

- Grand children also eligible

- Builds cash for child's future

- Start Life Insurance for child to have as an adult

- CSEA endorsed

- Payroll deducted

Retirement Counseling

Available to all CSEA members planning retirement. This free, no obligation service is available to help you maximize your pension income, regardless of any other retirement income you may be entitled to, such as Social Security. Highlights include:

- Four plan options to meet your retirement needs

- Clear overview of retirement options available

- Guidance on continuing your CSEA Life Insurance after retirement

- Counseling on ways to maximize retirement income, while still providing future protection for spouse and family

- Guidelines on creating a position of flexibility within your pension

Personal Lines Insurance Program

Available to all CSEA members at any time. Obtaining Umbrella liability, however, requires that both your automobile and home owners coverage are written under the CSEA Personal Lines Insurance Program. Highlights include:

- Convenient payroll deduction

- Automobile/Homeowners/Renters Insurance

- Mobile Home Coverage

- Umbrella Liability Insurance

- Package Policy - combining home, auto, and/or umbrella coverage at discounted rates

- Continuation of coverage beyond employment

- A variety of carriers to provide the best match for you coverage needs

Hospital Indemnity Insurance

Available to all active and retiree CSEA members, and their spouse, regardless of age or health not currently confined for medical care or treatment in an institution or at home, and not on fulltime active duty in the armed forces. Highlights include:

- Daily Benefit Plan Options: benefit of $55, $77, $110, $138 , $165 or $220 per day

- Twice your Daily Benefits for each day in intensive care up to 90 days

- Up to $800 for covered Surgical Procedures

- Extended Care Facility benefits

- Benefits for ambulance service to hospital

- Benefits for outpatient hospital visits

- Second Surgical Opinion benefit

- No maximum age limits

- No individual cancellation for claims

- Benefits up to six months in a convalescent home

- Benefits payable from the first or third day of hospitalization

- Double benefit for confinement due to cancer if not confined in intensive care, up to 7 days in one year

- Insurance provided by New York Life Insurance Company, 51 Madison Ave. New York, NY 10010

CSEA Long Term Care

Available to all CSEA members. Typically purchased by retirees and those preparing to retire. The program is available through direct bill. Highlights include:

- Designed to cover extended periods of care either in a nursing home, adult day care center, assisted living facilities or at home

- New York State Partnership Plan, to protect assists of insured members residing in New York State

- Competitive rates plus discount to CSEA members and their spouses

- Many waiting periods, daily benefit amounts and inflation options to choose from

CSEA Valuable Insurance Programs

Dear CSEA Member:

Insurance rates can vary greatly from one insurance company to another. In recognition of this, the CSEA Valuable Insurance Programs (VIP) has arranged a "buying service" to give CSEA members low cost options for their auto and property coverage. Your CSEA VIP Program has found the insurance plans that work for you!

Print out the VIP Information Card and mail it in to get your insurance assistance.

Insurance Program

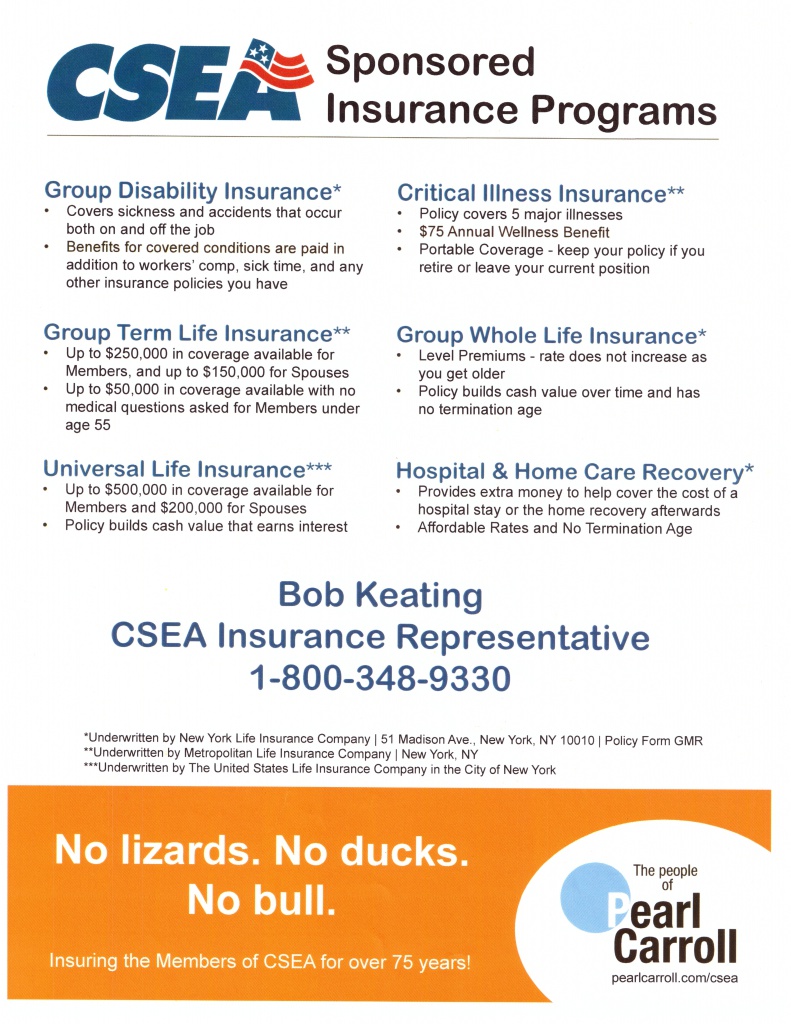

A wide variety of insurance products that can help to protect the personal financial security of CSEA members.

- Term Life (Security Life)

- Disability Income

- Universal Life (Protection Plus)

- Group Whole Life

- Critical Illness

- Retiree Hospital Indemnity

- Retirement Counseling

- Long Term Care

- Sign up for a review of your CSEA Insurance

Call me to set up an appointment

Bob Keating,

CSEA Insurance Agent

office: (800) 348-9330

email: robert.keating@pearlcarroll.com